The lower copper goes the bigger the opportunity.

Search Results for: lithium

Trump or Harris? Who Cares! These Commodities Will Perform Either Way

One certainty is: drill, baby, drill!

What is the ‘Trump Trade’ for Tech?

Trump’s potential comeback could reshape investment strategies, where do you need to look next?

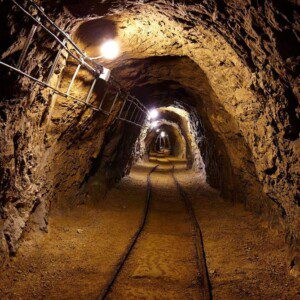

How This Aussie Miner Could Become The Next Big ‘AI Stock’

Updated July 2024 After much searching, I’ve finally found it! You see, for some time, I’ve been obsessed with a particular theme: the crossover of mining and AI. It was an unlikely partnership, with thus far few prospects. But I knew if I found that rare ASX mining stock that could soar with the AI […]

Your market ‘cheat sheet’ is coming…next month!

We’re one month away from the market revealing its ‘tells’…

After two years on the canvas, this stock is showing signs of life

Also, market breadth falls as oil, copper and gold rally